Feel free to leave your vote:

27

Share template with others

Summary

Report submitted for Onyx Data DataDNA ZoomCharts Mini Challenge, December 2024. The report is based on the Aurora Bank dataset and includes ZoomCharts custom Drill Down PRO visuals for Power BI.

Author's description:

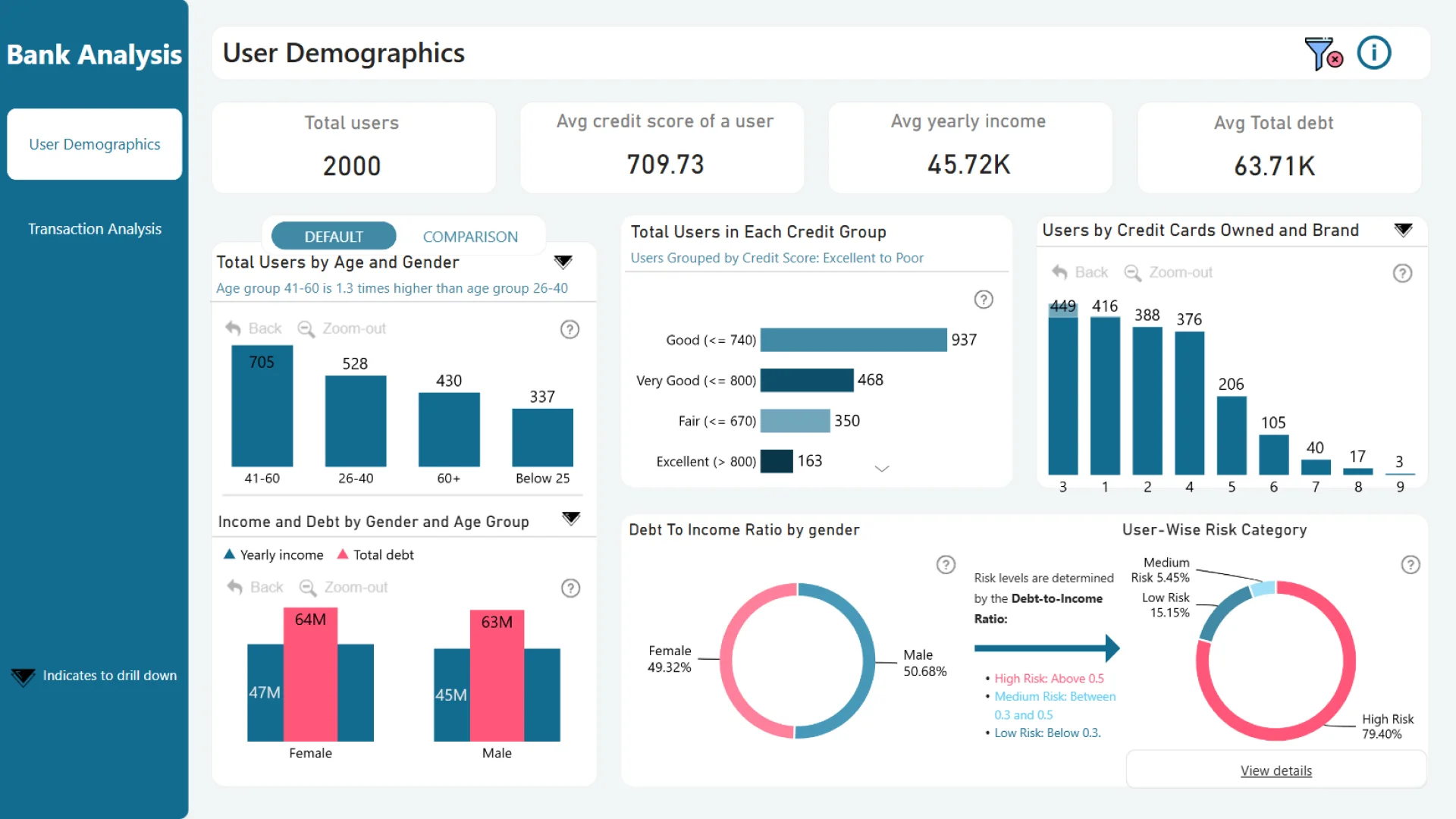

BANK ANALYSIS: User Demographics

The Aurora Bank analysis reveals 2,000 users with an average credit score of 709 and an income of $45.72K. However, their average debt is significantly higher at $63.71K. Most users fall within the 41–60 age group, with females earning slightly more but carrying higher debt. Males, on the other hand, have a higher debt-to-income ratio. Alarmingly, 79.40% of users are classified as high-risk, emphasizing the need for enhanced debt management and support programs.

Transaction Analysis

Aurora Bank processed 157.22K transactions totaling $6.87M, with an error rate of 1.74%. California leads in transaction value, while Houston records the highest transaction volume. Money Transfers and Supermarkets are the top categories. The most common errors include Insufficient Balance (71.20%) and Bad PIN (15.70%). The highest transaction occurred in July 2023, whereas the most errors were reported in April 2024. Efforts should focus on reducing errors and improving transaction processes.

ZoomCharts visuals used

Mobile view allows you to interact with the report. To Download the template please switch to desktop view.