Feel free to leave your vote:

2

Share template with others

Summary

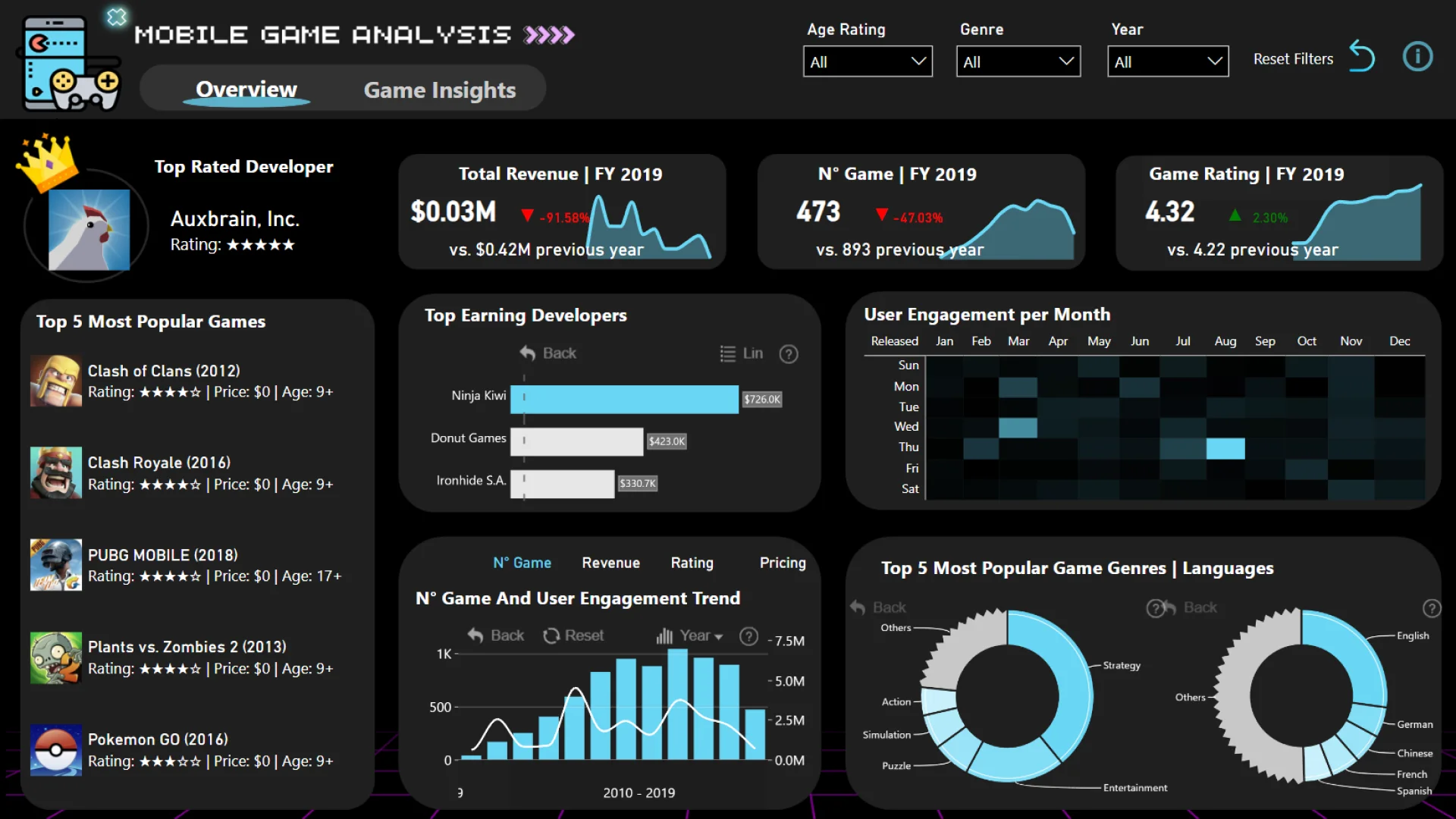

Report submitted for FP20 Analytics ZoomCharts Challenge 18 (August 2024). The report was built with the Mobile Game Analysis dataset and includes ZoomCharts custom Drill Down PRO visuals for Power BI.

Author's description:

The report I created includes two pages: an overview and detailed game insights. It offers key insights into the current gaming market, covering trends in ratings, pricing, user engagement, and genres, along with recommendations for new developers on selecting the right price points or genres to succeed in the market. This dashboard specifically analyzes apps that are actively used by users, meaning those that have received user ratings.

Key Insights:

- The top 5 most popular games from 2008 to 2019 are all free-to-play, with Clash of Clans (2012) and Clash Royale (2016) leading the list, both targeting players aged 9+.

- Game revenue fluctuated between 2008 and 2019, peaking in 2009 and hitting a low in 2019, despite the number of games in 2019 being more than double those in 2009. This could be due to the higher presence of paid games with strong user engagement in 2009. Among developers, Ninja Kiwi generated the highest revenue, followed by Donut Games and Iron Hide.

- The number of game launches saw significant growth from 2008 to 2016 before declining to nearly half of its peak by 2019, although average game ratings improved during this period. Auxbrain emerged as the developer with the highest average composite game rating which is based on average user rating and average user rating count. Additionally, average game prices decreased from 2008 to 2019, with lower-priced games showing higher user engagement. Clash Royale, PUBG Mobile, and Pokémon Go had the highest user engagement (i.e., user rating counts) from 2016 to 2019.

- Strategy games and English language options are the most popular in their respective categories. New developers should consider focusing on these to attract a larger audience.

- The majority of games in the app store are free or priced below $4.99, categories that seem to draw the most players. It is recommended that new developers adopt a similar pricing strategy, potentially offering free games monetized through advertising or setting a low price point.

- There is a positive correlation between price and game size, with larger games typically having higher unit prices. However, free and low-priced games often receive higher user ratings and user engagement. Strategy and entertainment genres tend to feature larger games.

- While games rated for ages 4+ are the most prevalent in the market, those rated for ages 9+ see greater user engagement. Over 50% of games receive excellent user ratings (above 4.5), with strategy and entertainment genres leading in this area. Based on the insights provided, it is recommended that new game developers should target players interested in free or low-priced games, focus on the 9+ age group, create strategy and entertainment games, and prioritize English-speaking audiences. By focusing on these segments, new developers can maximize their chances of success in a competitive market.

ZoomCharts visuals used

Mobile view allows you to interact with the report. To Download the template please switch to desktop view.