Feb 02, 2016

Data Visualisation for Online Banking

How do you feel when you are presented with a large volume of unexciting data which can actually take hours to extract any meaningful insight? To be more...

How do you feel when you are presented with a large volume of unexciting data which can actually take hours to extract any meaningful insight? To be more...

To find this information, you’re almost forced to go through a series of never ending dropdown lists and clicks in your online bank statement grid. If you’re a little more tech savvy than your average customer, then you might export the result to a spreadsheet and work for a few hours to extract some meaning out of the data grid.

By the mere thought of it, you got exhausted and unmotivated... right. In absence of a quick data visualisation in your UI, this is how your customers might be going through on a regular basis.

Is your bank / financial institution a digital laggard?

Becoming a digital bank is no longer optional... it has become inevitable. Unfortunately, Banking/Finance sector lags in customer centric technology. When we look around the globe we found out that the banks can still be classified into 4 categories of development vis-à-vis their web presence in general & data visualisation in particular?

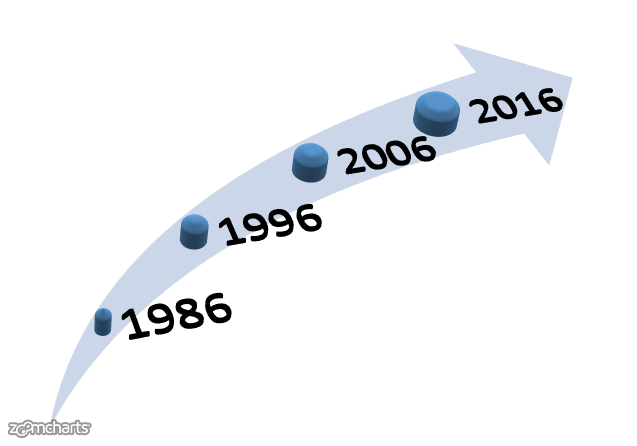

1. 1986 type - The banks that are still in stone age err paper age... frozen in time! They feel good by communicating with their customers only via printed passbook (sometimes even hand written!). No online presence. You may not find this category in Europe, North America or Asia Pacific but they do exist in rest of the world, yes... even in 2016!

2. 1996 type – Their online interface just works for the name sake without any value add to their customers. Buckled under the strain of their ageing legacy systems, they’re maintaining the status quo from past 20 years!

3. 2006 type – They’ve a decent online presence and have certainly tried to provide insights into the data by using various data visualization techniques like graphs & charts. But they’ve failed to evolve as they pretty well assumed that all of their internet savvy customers are accessing their online interface on a 14’’ monitor! In past 5 years or so, things have radically changed and more customers are accessing internet on the move on a smartphone than on desktop/laptop. Mobile App-only approach is catching up and few businesses are already shutting their websites off in favour of Apps.

4. 2016 types – These are technology leaders and early adopters. They’ve truly lived up to their customer expectations. Apart from running a stable banking services, they’ve added that wow factor to their online user interface by integrating modern data visualisation libraries – which works well on any screen on any device.

Challenges of a Banking UI - Big picture along with the related details in minimum clicks

With the new WhatsApp/Twitter generation ready to join the banking & financial institutions as customers, you need to stay on top of emerging web technologies to regain your competitive footing. The customer behaviour in 2016 & beyond is definitely undergoing a sweeping change. If you’re still in 2006, evolve or lose customers faster than you can ever think of.

Merely providing data is not enough to retain customers & sustain their loyalty. As they say, time is the new money and if you don’t respect your customer’s time you are certainly going to lose them. You should make them fall in love with your services & interface.

Can your existing interface show your customer the big picture along with the related details in minimum number of clicks? Most of the existing banking applications UI suffer from the following downsides:

- Filter Clusters

Complex filters & search forms - a nightmare to go thru - Blind Guessing

You’ve to scan thru everything to find a particular transfer - Mobile Last

Better not to try this experience on a mobile device

Don’t believe the FUD

Security & Stability of the application – These are the popular FUD (fear, uncertainty, doubt) around adoption of emerging technology in banking & finance that thwart any attempt to experimentation. You can no longer stay away from the new technology on the pretext of security & robustness of applications. Come out of your legacy & your comfort zone to make your customer’s life easier and add value to their experience.

Why you should integrate data visualization to your online interface

The answer is simple, data without a quick insight is noise. Visualization is a tool to find meaning & explore relevant aspects in an otherwise dull data. Visualization empowers your customers to make quick decisions based on the evaluation of the related information. Data visualisation saves considerable amount of time.

“Banks will have to improve the customer experience if they want to keep their position in core markets.”

- Pascal Martino [Partner and Digital Leader at Deloitte Luxembourg.]

Why ZoomCharts for banking user interfaces?

ZoomCharts is not yet another HTML5 library. It’s the world's most interactive chart and graph library. It is backend agnostic and can be easily integrated with any existing data. Unlike other chart libraries where mobile compatibility is stitched later on - ZoomCharts is in fact built with a Mobile First approach – our USP. The other important aspect of a UI can be understood from the following quote.

"Digital banking applications will be judged based on the lack of touches needed to get from point A to point B.”

-- thefinancialbrand.com

ZoomCharts design and user experience is in complete agreement with what it takes to minimize the number of clicks and related clutter to access information.

Bottom-line

Touch screen displays will become a $31.9B market by 2018. The internet usage on Smartphones have already exceeded that of the laptops/desktops. With fast emerging IoT technologies your customer might wish to viewing her bank statement on a smart TV screen or on a tiny wearable screen. Do you want to transform the online experience of your customer by applying some visual interactive chart and graph via ZoomCharts? If yes, you’re certainly marching ahead of the competition in customer retention and loyalty.

Want more info like this?

Subscribe to our newsletter and be the first to read our latest articles and expert data visualization tips!